Listen to our recent podcast with The Small Business Mastermind.

Canada Recovery Benefit (CRB)

Canada Emergency Business Account (CEBA)

Canada Emergency Wage Subsidy (CEWS)

10% temporary wage subsidy

Work from home deduction

Canada Emergency Commercial Rent Assistance (CECRA)

Canada Emergency Response Benefit (CERB)

Alberta's Emergency Isolation Support Payment

WCB premiums (Alberta)

GST credit enhancement

Canada Child Benefit enhancement

Farmers loans

Other small business COVID-19 support

Show your support for frontline health workers

Worried about business uncertainty?

Employees in self-isolation?

Canada Recovery Benefit (CRB): $500/week for up to 26 weeks

For self-employed individuals or those not eligible for Employment Insurance (EI), but need income support due to COVID-19, this program provides $500/week for up to 26 weeks. This program will run from September 27, 2020 to September 25, 2021, and is administered by the Canadian Revenue Agency (CRA).

Requirements for CRB:

-

You were not employed or self-employed due to COVID-19, or your income dropped by at least 50% due to COVID-19

-

Workers must be actively looking for work, and accept work where reasonable to do so. (But you did not qualify for EI.)

-

You earned at least $5,000 in 2019 or 2020, or in the 12 months prior, from employment or self-employment

-

You have not quit your job or reduced your hours voluntarily after September 26, 2020

-

You did not apply for (or receive) any of the following:

-

You reside in Canada, were present in Canada, have a valid Social Insurance Number (SIN), were at least 15 years old

Applying for CRB

Applications need to be submitted for each two-week period, and you can apply up to 13 times. You must apply within 60 days of the period end date. The first period is September 27 to October 10, 2020, so you need to apply by December 8, 2020.

You will need to apply through your CRA MyAccount. If you have not registered for your account, you can do that on the CRA website. If you're locked out of your account, you can call 1-800-959-8281 for help accessing the account.

CRB repayment

You may earn employment or self-employment income while you receive CRB, but there is a $38,000 income threshold for each year. If you have, or will earn over $38,000 in income in 2020, you will have to repay the CRB benefits at a rate of 50 cents for every dollar of income earned in that year over $38,000. This income would not include CRB benefits, and you will not need to repay more than the CRB benefits you received.

If your net income is under $38,000 for 2020 and 2021, you will not have to repay CRB.

Taxes withheld on CRB payments

For each two-week period, you will receive $1,000, but the CRA will withhold $100 for income taxes. You may owe more (or less) than 10%, so be prepared to have to pay taxes when you file. You will receive a T4A slip for this income.

Calculating 50% reduction in average weekly income

Self-employment income is your revenue minus expenses incurred to earn that self-employed income. This includes tips and non-eligible dividends, but does not include an other pension income, EI benefits or COVID-19 government relief.

You must show that your weekly income has decreased by at least 50% compared to your 2019 average, 2020 average, or the last 12-month average. To calculate this, you can take your total income for one of those three periods, and divide it by the number of weeks in the period.

For example, if you earned $60,000 in 2019, divide that by 52 weeks, for average weekly income of $1,153.85. Your income for the period you're applying for must be less than $576.92 (50% of $1,153.85).

Returning a payment

If you received a CRB payment and later realize you should try to return that payment, try to do it before December 31, 2020.

Canada Emergency Business Account (CEBA): $40,000 loan

CEBA is an interest-free loan for small businesses for up to $60,000 (up from $40,000). You apply for this through your business bank.

The intention of CEBA is to help businesses cover their operating costs during the COVID-19 pandemic. Businesses need to repay the balance of the loan by December 31, 2022, but it is interest-free until the end ofDecember 31, 2022. If the loan is repaid in full, the government will forgive up to a third of your loan. Learn more about the Canada Emergency Business Account.

- Applicants who have received the $40,000 CEBA loan may apply for the $20,000 expansion, which provides eligible businesses with an additional $20,000 in financing.

- All applicants have until March 31, 2021, to apply for $60,000 CEBA loan or the $20,000 expansion.

- Check your CEBA loan application status.

Forgivable portion of CEBA is taxable come now

The forgivable portion of the CEBA loan is considered taxable income in the year the loan is received. So, if you got the $60,000 loan in 2020, you'll need to add $20,000 in taxable income to when you're filing your taxes this year.

This will cost you $2,000 in additional corporate taxes this year if you have taxable income. If you're in a loss, even after the additional $20,000, it won't cost you anything.

If you received $40,000 in 2020, you'll be taxed on the $10,000 in 2020. Then if you get the additional $20,000 in 2021, you'll be taxed on another $10,000 for 2021. If you don't repay the loan by the December 31, 2022 deadline, you take the $20,000 deduction to cancel out the taxable portion.

Qualifying

There are two ways to access this program:

1. Your business had between $20,000 and $1.5 million in total payroll in 2019 to qualify.

2. Your business did not have payroll expense of at least $20,000, but it did have non-deferrable operating expenses between $40,000 and $1.5 million. Eligible non-deferrable expenses could include costs such as rent, property taxes, utilities and insurance.

To apply for this program, your business must have a bank account and filed your 2018 or 2019 tax returns.

All applicants must be able to show non-deferrable operating expenses in the amount of the loan (up to $60,000) as the loan must be used for these costs.

The program is now live, so contact the bank that holds your business's main operating/chequing account. Funds are disbursed within a few business days.

The funds may not be used to pay down other debt or make payments to owners (i.e. pay dividends or distributions), or increase the compensation of management.

You can contact the CEBA Call Centre at 1-888-324-4201 if you have questions.

Canada Emergency Wage Subsidy (CEWS) of 75%

How the program works:

The Canadian government will refund 75% of wages paid (up to $847/week or $3,388/month per employee) between March 15 and August 29, 2020. The application is open and available through your CRA MyBusiness Account. The funds should start be distributed a couple weeks after the application is submitted. Note that this has not been updated for the new requirements for periods 5 to 9.

Visit the CRA website for more detailed instructions on applying for the 75% wage subsidy.

The employer is expected to pay the remaining 25% (or more), but it doesn't sound like the employer contribution is required.

All amounts received from the government under this program will be taxable income to the business.

Determine if your business is eligible for CEWS

Your business is eligible if it meets ALL the following criteria:

- A small business with a CRA payroll account on March 15, 2020

- Business structure is one of a corporation, sole proprietor, trust, partnership or charity

- Business has experienced an eligible revenue reduction

If your business meets the first two criteria, the next task is to determine how much your revenue decreased since COVID-19 (starting March 15, 2020). You'll need to know how much revenue you did during the following months:

- January, February, March 2020 (and April and May 2020 when available)

- March, April and May 2019

Step 1: Determine revenue for March 2020

Use your normal accounting method when calculating revenue. You can use the cash method (cash received) or the accrual method (invoices generated).- % reduction = (Mar 2020 revenue-Mar 2019 revenue)/March 2019 revenue

- % reduction = (Mar 2020 revenue-(Jan 2020 revenue+ Feb 2020 revenue)/2))/(Jan 2020 revenue+ Feb 2020 revenue)/2))

We did have a CEWS calculator, but the requirements have gotten too complicated for periods 5 to 9.

Conclusion: You're eligible for period 1 if your decline in revenue is 15% or greater. If you qualify for period 1, you automatically qualify for periods 2. If you qualify for period 2, you automatically qualify for period 3.

Keep in mind that the drop in revenue must be related to COVID-19.

If you don't meet the 15% required reduction in revenue for March 2020, then you can do the test for Period 2, 3, 4, etc... as described here:

| Claim period | Start and end dates | Baseline revenue | Claim period revenue | Required reduction |

|---|---|---|---|---|

| 1 | March 15 to April 11, 2020 |

|

March 2020 | 15% |

| 2 | April 12 to May 9, 2020 |

|

April 2020 | 30% |

| 3 | May 10 to June 6, 2020 |

|

May 2020 | 30% |

| 4 | June 7 to July 4, 2020 |

|

June 2020 | 30% |

Once you have determined that your business meets the required reduction in revenue for a particular claim period, you're automatically considered to have met the required reduction in revenue for the immediately following claim period (deeming rule). As a result, you do not have to do this calculation again for that next claim period (see Table 2 below).

However, this deeming rule does not automatically extend to apply to the period after that next claim period. For example, if you met the condition for the reduction in respect of the first claim period, March 15 to April 11, 2020, then you will be considered to have met the required reduction in revenue in respect of the second reference period, April 12 to May 9, 2020, without necessarily do the calculation. But you will have to make a determination for the third claim period, May 10 to June 6, 2020.

| Claim period 1 March 15 to April 11, 2020 |

Claim period 2 April 12 to May 9, 2020 |

Claim period 3 May 10 to June 6, 2020 |

|---|---|---|

| Reduction of revenue of less than 15% Does not qualify under the regular rule |

Reduction of revenue of less than 30% Does not qualify under the regular rule |

Reduction of revenue of less than 30% Does not qualify under the regular rule |

| Reduction of revenue of less than 15% Does not qualify under the regular rule |

Reduction of revenue of 30% or more Qualifies under the regular rule |

Reduction of revenue of less than 30% Does not qualify under the regular rule but qualifies under the deeming rule (because the employer meets the 30% reduction of revenue in the claim period 2) |

| Reduction of revenue of 15% or more Qualifies under the regular rule |

Reduction of revenue of less than 30% Does not qualify under the regular rule but qualifies under the deeming rule (because the employer meets the required 15% reduction of revenue in the claim period 1) |

Reduction of revenue of less than 30% Does not qualify under the regular rule The deeming rule does not apply because the reduction of revenue during the claim period 2 was not 30% or more. |

| Reduction of revenue of 15% or more Qualifies under the regular rule |

Reduction of revenue of 30% or more Qualifies under the regular rule as well as under the deeming rule (because the employer meets the 15% reduction of revenue in the claim period 1) |

Reduction of revenue of less than 30% Does not qualify under the regular rule but qualifies under the deeming rule (because the employer meets the 30% reduction of revenue in the claim period 2) |

| Reduction of revenue of 15% or more Qualifies under the regular rule |

Reduction of revenue of 30% or more Qualifies under the regular rule as well as under the deeming rules (because the employer meet the 15% reduction of revenue in the claim period 1) |

Reduction of revenue of 30% or more Qualifies under the regular rule as well as under the deeming rules (because the employer meets the 30% reduction of revenue in the claim period 2) |

Calculating the wage subsidy amount

Step 1: Determine which employees are eligible for the 75% wage subsidy.

Any employee that your business pays wages, or has on payroll, would qualify for the subsidy.

For each employee, you will need to determine their baseline wages, which are the average weekly wages paid to the employee during the period of January 1, 2020 to March 15, 2020. The baseline wages are used to determine the following:

- Arm's length employees: For employees whose wages were reduced because of COVID-19, the subsidy can still be determined based on the pre-COVID wages (January 1 to March 15, 2020).

- Non-arm's length employees: Owners might try to increase their wages to try to claim a higher wage subsidy. To prevent this, the subsidy would be calculated based on pre-COVID wages (January 1 to March 15, 2020).

*Arm's length means they are a shareholder, or a family member of a shareholder.

The CRA has created a Wage Subsidy Calculator. Take a look and see for yourself how helpful it is.

Step 2: Complete the wage subsidy calculator prior to completing the application.

Here are the pieces of information you will need for each employee prior to completing the calculator:

- Wages paid to each employee between January 1 and March 15, 2020

- Wages paid to each employee during the period you're applying for (e.g. Period 1 is March 15 to April 11, 2020)

- Amount of employer portion of CPP and EI paid for each employee on furlough during the period

- Name and social insurance number (SIN) of each employee and whether they are arm's length to the business

- The amount claimed under other programs like the 10% wage subsidy or the Work-Sharing Program.

There is a limit per employee, but no limit per business (or employer).

After you apply for the wage subsidy, your claim will be subject to verification. This includes providing a full list of your employees and their Social Insurance Numbers, and their payroll records for January 2020 through August 2020. So remember to keep detailed records and calculations.

CRA MyBusiness Account

If you have never accessed your CRA MyBusiness Account, you should register immediately here. Fill out the application and the CRA will mail you an access code, which will arrive in five to 10 business days, and is required to complete your registration.

10% temporary wage subsidy

The original wage subsidy of 10% will still be available for business owners that do not qualify for the 75% Canada emergency wage subsidy. This program will cover 10% of the gross wages you pay from March 18, 2020 to June 19, 2020, up to $1,375 for each eligible employee and to a maximum of $25,000 total per employer.

When determining your next payroll remittance (due April 15), you determine the Gross Payroll between March 15 and March 31, and calculate 10% of it. Then you would reduce the Income Tax portion of your payroll remittance by that amount. You still need to pay the full amount of CPP and EI, so this is only a reduction to the income tax portion of the payroll remittance.

Keep record of total wages paid between March 15, 2020 and June 20, 2020, and the number of employees paid during that time. You (or your payroll provider) will be responsible for calculating your own subsidy — the CRA will not do this for you.

The subsidy will be considered taxable income to your business.

For businesses that moved on the 10% wage subsidy and reduced their March payroll remittance (due April 15) and are now wanting to apply for the 75% wage subsidy (which is a refund cheque), your refund cheque will be reduced by the amount claimed under the 10% subsidy.

Work from home deduction

If you worked from home during the COVID-19 pandemic, there are two ways you can claim tax deductions:

1. Claim $2/day flat rate to a max of $400. There is no documentation or employer sign-off required. You must have worked more than 50% from home, for a minimum of four consecutive weeks. Read all the qualifications.

2. Claim actual expenses. You'll need a T2200 form from your employer with their sign-off.

You do not qualify for this deduction if your employer reimbursed you for your expenses.

Canada Emergency Commercial Rent Assistance (CECRA)

Under this plan, eligible small business tenants pay 25% of their current rent, the landlord pays 25%, and the government will cover 50% of rent for the months of April, May and June. It is expected this program will be operational by mid-May.

Commercial landlords with eligible tenants (see below) will receive a loan from the federal government for 50% of the rent they receive from the eligible tenant for those three months. If the landlord reduces (not defers) the rent for the tenant by 75%, the government will forgive the 50% loan to the landlord. If the tenant pays more than 25% of their rent for April, May or June, the landlord will be need to repay the loan to the government.

Eligible tenants meet ALL of the following criteria:

- A small business that pays commercial rent of less than $50,000 per month

- The small business has either ceased operations, or experienced a drop in revenue of more than 70%, due to COVID-19

Qualifying commercial landlords meet ALL of the following criteria:

- Have a commercial lease agreement with a small business or not-for-profit tenant, in place during the months of April, May and June 2020

- Agree not to evict their eligible tenant during these months

- Have a mortgage on the property

- Will reduce rent for those tenants by 75% for these months, and do not require that rent to be repaid later

The federal and provincial governments are teaming up to roll out and enforce this new program that will help small businesses with their rent obligations as tenancy is under provincial jurisdiction.

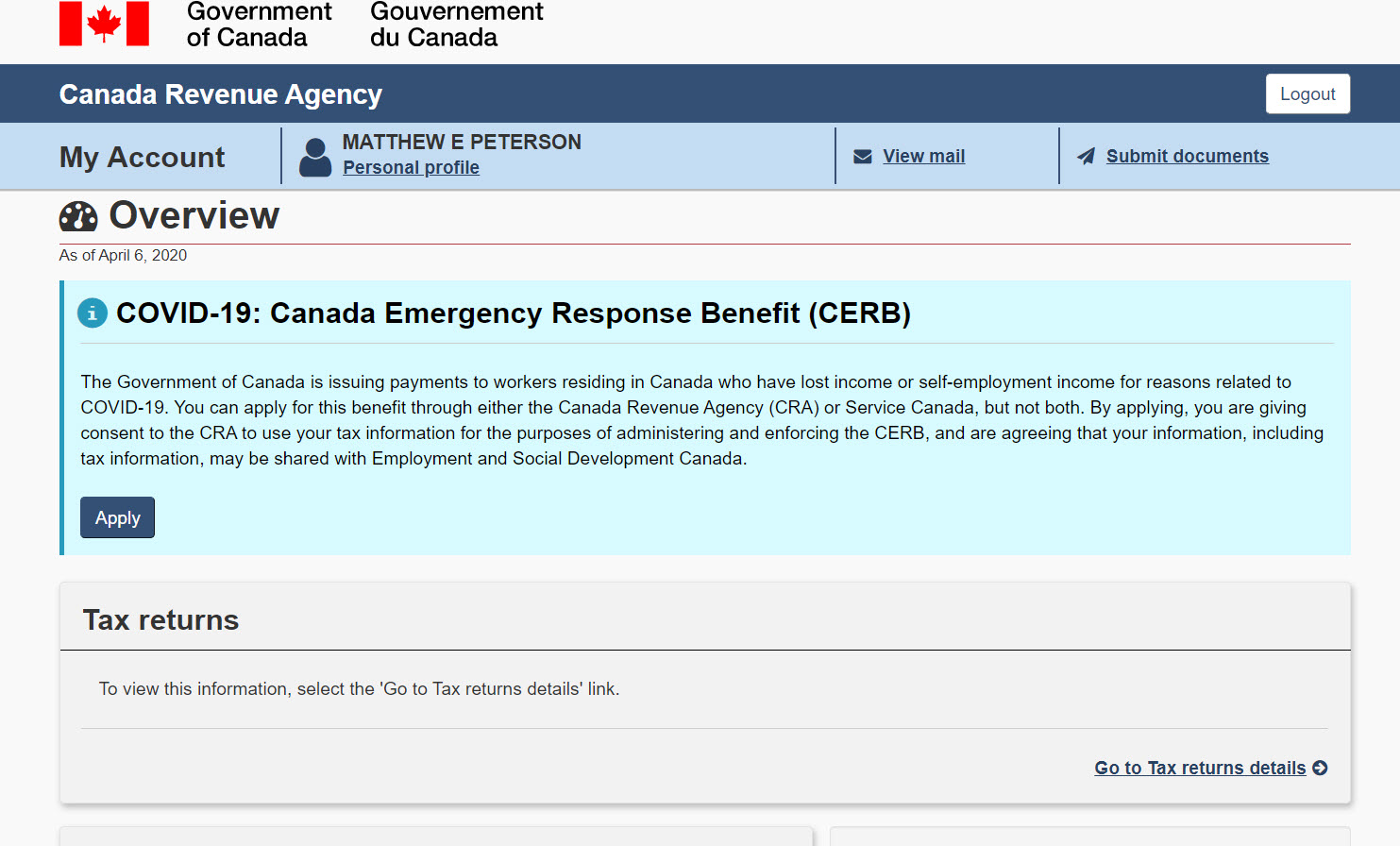

Canada Emergency Response Benefit (CERB) $2000/mo

This final period for CERB ended September 26, 2020, but the application remains open and is available through your CRA My Account.

The CERB is sort of a catch-all benefit for anyone that is out of work because of COVID-19, whether they are EI-eligible or not. This is a taxable payment of $2,000/month, made every four weeks, for up to 16 weeks, and capped at $8,000 each. The program is effective from March 15, 2020 until October 3, 2020. If you apply with direct deposit, payments are made within three business days. Cheques will take at least 10 business days after your application is submitted.

Applicants will also be able to apply via an automated telephone line or via a toll-free number (1-800-959-2019). You can find more info on the CERB on the Government of Canada website.

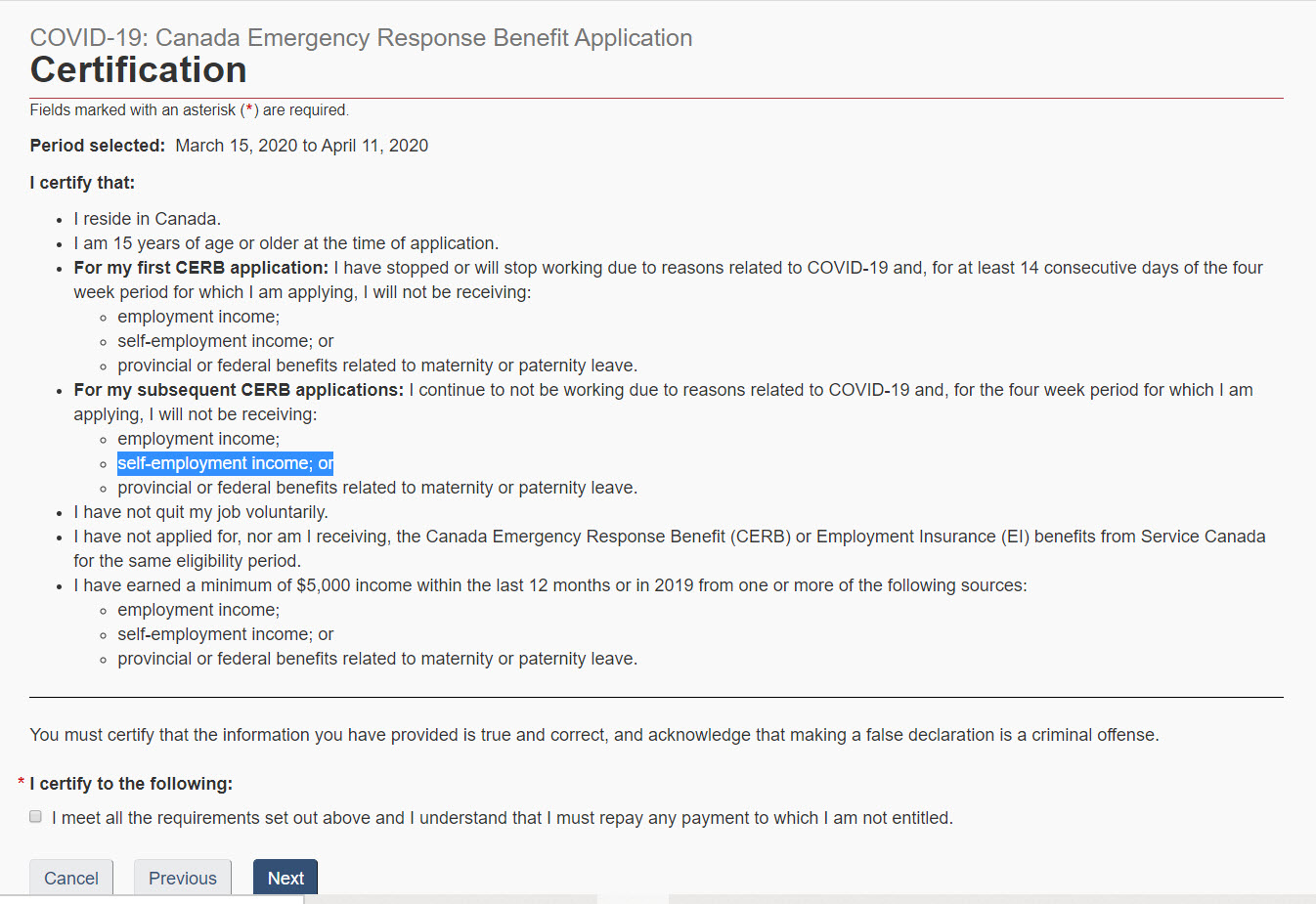

If you collect the CERB and later find out you did not qualify, there are ways to return or repay the CERB payments.Who's eligible?

The CERB applies to any Canadian who has lost their income due to COVID-19, even those who are not eligible for EI. This means wage earners, as well as contract workers and self-employed individuals.

- You reside in Canada

- You are 15 years old or more when you apply

- For your first CERB application:

- You have stopped or will stop working due to reasons related to COVID-19

- For at least 14 days in a row for the period you are applying for, you will not receive more than $1,000 of:

- employment income

- self-employment income

- provincial or federal benefits related to maternity or paternity leave

- For your subsequent CERB applications:

- You continue to not work due to reasons related to COVID-19

- For the 4 week period (April 12 to May 10) you are applying for, you will not receive more than $1,000 of:

- employment income;

- self-employment income; or

- provincial or federal benefits related to maternity or paternity leave.

- You have not quit your job voluntarily

- You did not apply for, nor receive, CERB or EI benefits for the same period

- You earned a minimum of $5,000 income in the last 12 months or in 2019 from one or more of the following sources:

- employment income

- self-employment income - wages, dividends, or sole proprietor income

- provincial or federal benefits related to maternity or paternity leave

This is eligible to Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19. It is also eligible to working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures. This includes self-employed people like consultants, tradespeople and freelancers.

The main qualification is that income has been lost due to COVID-19. If you weren't earning wages, dividends or sole-proprietor income before March 15, you wouldn't qualify. But if both spouses have lost income, both would qualify.

Note: To be safe, we would suggest obtaining a letter from your employer, explaining that your dismissal or unpaid leave is directly related to COVID-19. Trudeau has been very clear that there will be consequences for those trying to game the system.

How to apply:

- Log into you CRA MyAccount.

- Go to COVID-19: Canada Emergency Response Benefit in the alert banner at the top of the page and click the Apply Button.

3. Select the period you want to apply for.

4. Declare that you qualify for the benefit. Here is a list of the requirements:

5. Enter your direct deposit info and confirm.

To help the government manage the amount of applications, they have set out the following guidance:

| If you were born in the month of | Apply for CERB on | Your best day to apply |

|---|---|---|

| January, February or March | Mondays | April 6 |

| April, May, or June | Tuesdays | April 7 |

| July, August, or September | Wednesdays | April 8 |

| October, November, or December | Thursdays | April 9 |

| Any month | Fridays, Saturdays and Sundays |

*If you've never registered for your CRA MyAccount, you should do that as soon as possible. You need to submit the registration form, and then the CRA will mail you (yes, snail mail!) an access code, which will take five to 10 business days. We've heard that if you call them after your application is submitted, they will be able to email you your access code. You need this code to complete your MyAccount and start the CERB application. This is something your accountant cannot do for you.

Alberta's Emergency Isolation Support Payment $1,146

This program is now closed. Alberta distributed $91.7 million to 79,596 Albertans, almost double the amount originally allocated.

WCB premiums (Alberta)

WCB premiums are deferred until early 2021. If you've already paid your WCB premium for 2020, you may be eligible for a rebate or credit for next year. Also, the government is going to cover 50% of the premium when it is due.

GST credit enhancement

Individuals will get a one-time special payment in early May through the GST credit. This will double the maximum annual GSTC payment amounts for the 2019-20 benefit year. The average boost to income for those benefiting from this measure will be close to $400 for single individuals and close to $600 for couples. The GST credit is income tested, so this will mostly benefit lower-income households.

You will need to file your tax return to get this GST credit enhancement.

Canada Child Benefit enhancement

The government is proposing an increase to the maximum annual Canada Child Benefit (CCB) for the July 1, 2019 to June 30, 2020 benefit year. The overall increase for families receiving CCB will be approximately $550 on average; the maximum increase families will receive is an extra $300 per child as part of their May payment. Again, you have to file your taxes to get this enhancement.

Farmers loans

If you're a farmer with a government loan, there are new interest-free payment deferral options for you. The deadlines have also been pushed back. Visit Advance Payments Program (APP) for more info.

Other small business COVID-19 support

Mortgages

Small business loans

City utilities, power and gas

The City of Calgary is allowing people to defer their utilities bills by just paying part of it or none at all. They will still send out water, wastewater, sewer, waste, recycling and composting bills in April, May and June, and it's up to the payer to choose how much they want to defer. The amount you don’t pay will be spread across your utility bills for the last six months of the year, without penalty or accrual of interest.

Student loan payments

Interest will automatically be deferred interest-free for six months.

Show your support for frontline health workers

The City of Calgary, Alberta Health Services, and United Way have banded together and created the COVID-19 Community Response Fund. This fund provides support for social service agencies who take care of the most vulnerable people in our community.

Worried about business uncertainty?

Life as we know it has slowed way down, and we don't know how long it will last. If you're a small business owner and you expect sales to drop significantly during this pandemic, here are a few tips and resources to help you through this:

Conserve as much cash as possible. Let us know if you need any help fielding calls from your lender, landlord, or CRA. If you are having a tough time adjusting to the new realities of isolation and stress on the home front, you can always reach out to the professionals at the Calgary Counselling Centre for help. Credit Counselling at Money Mentors may also be helpful.

The hope is that a combination of all these initiatives will help small business owners in Alberta hang in there. Let us know if there’s anything you have questions about. It's going to be a tough go for the next while, but hopefully not too long. Stay positive.

Employees in self-isolation?

If an employee of yours has to self-isolate, you should work with them to explore alternate working arrangements like working from home or another space.

If an alternate working arrangement is not possible, employees can use sick days and vacation days, and get paid for those days, without risk of losing their job. The Government of Alberta amended labour standards and now businesses must offer employees 14 days of paid, job-protected leave for COVID-19. It's unclear who will pay for this [business owners, Alberta government, federal government (EI), or a combination].

Small businesses owners are responsible for their people and we all need to do our part, so be flexible with your staff if they feel the need to isolate and stop the spread of coronavirus.

Read more about Small Business Basics topics that may be helpful to you and your small business.