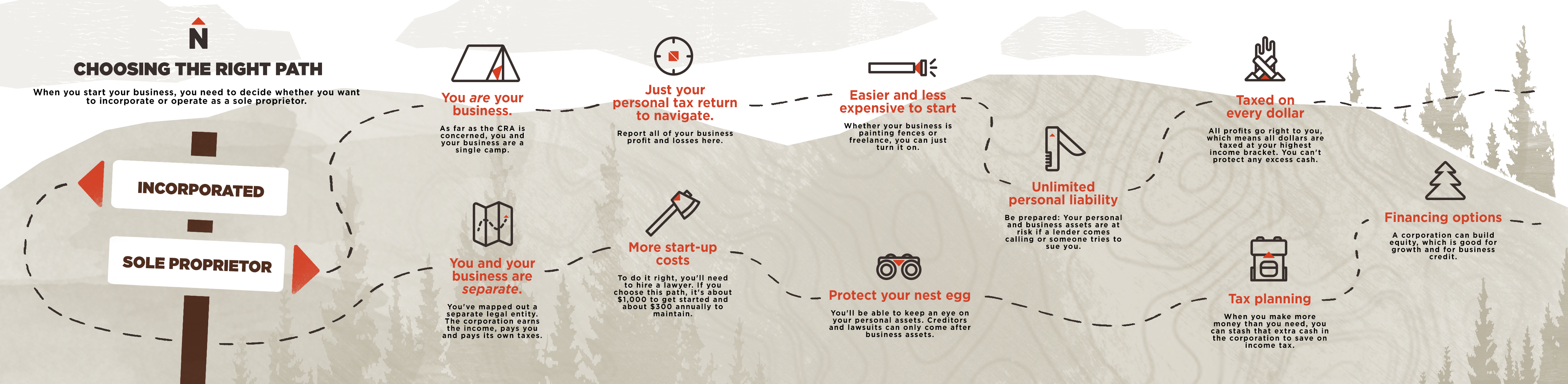

When you start a business, should you become a sole proprietor or incorporate? We get this question a lot, and it’s important to understand the pros and cons of each. In this blog, we explain the tax implications of sole proprietorship and incorporation so you can decide which is right for your small business.

VIDEO: Matt at True North Accounting talks about when a sole proprietor should incorporate.

What does sole proprietor mean?

When you start on your own as a freelance consultant or self-employed trade or professional, sole proprietor is the default category. There is no separation between you and your business — you are your business, and you report your business income on your personal tax return.

What is a corporation?

When you incorporate, you create a legal entity that is separate from you: a corporation. A corporation makes its own money, owns its own assets, is responsible for its own liabilities and pays its own taxes. The corporation operates the business, earns the income and then pays you. You can get paid either as an employee of your corporation (wages) or as a shareholder/owner of your corporation (dividends).

The pros and cons of being a sole proprietor

Why should you be a sole proprietor? We outline some reasons below:

You can start right away.

You can literally start painting fences or selling logos today and you would be considered a sole proprietor. If you are more intentional about it, you can register your business name and location with Alberta Registries. Then, go to the bank and get a business chequing account and a credit card. Don't forget to get insurance if there's any risk or danger in your business. And boom, you’re ready to go.

It costs less.

Your set-up fee is nominal. You don’t need to hire a lawyer or accountant if you don't want to. It's cheaper to start up and to maintain each year.

Have one less tax return to file.

All of the business's income goes directly to you, so you file your profits and losses on your personal tax return. If your business does have losses, it may potentially bring down your tax owing for the year. However, the rules for GST accounts and payroll accounts with the CRA are the same for sole proprietors and corporations.

You may wonder what are the cons of being a sole proprietor?

You have unlimited personal liability.

Because there’s no separation between you and your business, you assume all the risk. If someone tries to sue you or a lender calls for their loan, all of your business AND personal assets are at stake. When you take on a partner or investor, you form a partnership, and your partners assume unlimited liability risk too.

You’re taxed on every dollar.

All profits go right to you, which means you’ll pay taxes on every penny. This makes it much harder to grow your bank account, (i.e. make more than you spend), because that excess cash is taxed at your highest tax rate.

Growth is more difficult.

As a sole proprietor, you can’t really take on equity investors and it can be harder to keep partnerships (two sole proprietors in business together) fair and equitable. It can be more difficult to keep organized as there is no separation between you and your business. And, there is no option for your business to live on after you’ve passed away.

SOLE PROPRIETORSHIP IS BEST FOR:

- Businesses with minimal legal or financial risks (talk to a lawyer)

- Businesses that don’t intend to grow or expand much

- Business owners who plan to spend all the money the business makes

If you’re still wondering if you should incorporate your small business, read more on our blog.

The pros and cons of incorporation

Why should you incorporate? Here are some advantages:

You can protect your nest egg.

Protect your home and retirement savings from creditors and lawsuits by operating through a corporation. They can only come after the assets owned by the corporation. To make sure you’re set up properly, use a lawyer and consult with an accountant. Your corporation will survive you and even exist in perpetuity if it's kept up to date.

You can choose how much tax to pay.

When you’re lucky enough to make more money than you need for living expenses, you can choose to leave that extra cash in the corporation. This helps you avoid bringing it all into personal income and paying tax on it.

Whatever you leave in the corporation is only taxed at 11%. You can leave this in the corporation as a rainy day fund, invest it or buy equipment (including vehicles) with it. This is called tax planning.

In comparison, if you were a sole proprietor and had a net income of $100,000, you would be taxed anywhere between 25-30%.

You have financing options.

A corporation can build equity, which is good for business credit and may give you more borrowing options from lenders, investors and partners. When it comes to government grants, incorporating will open up more options as well.

What are the cons of incorporation? There are a few.

Start-up costs can be expensive.

Setting up a corporation will cost you about $1,000 if you use a lawyer. You can also walk into your nearest Alberta Registries and do it for about $495.

Once the incorporation is set up, you’ll pay about $300 annually to maintain your minute books with a lawyer. Alternatively, you can file your corporate annual return yourself at the registries for about $85 a year.

You have to do more paperwork.

You will need to file a personal AND a corporate tax return, usually with accompanying notice-to-reader financial statements. But that’s what we are here for! You also need to file a return at the registries each year — like registering your car. It can also be a bit more confusing when you have so many CRA accounts: Personal Tax, Corporate Tax, GST, Investment and Payroll Accounts. A corporation also has different deadlines that you have to be aware of.

INCORPORATION IS BEST FOR:

- Business owners who plan to grow their business and make more money than they need

- Businesses with legal or financial risk

- Businesses that need to hire employees or raise money

Read more about Starting a Business topics that may be helpful to you and your small business. To get some more clarity on how to start your business in Alberta as a corporation, download our free ebook, The Path To Starting Your Own Business.

Contact us if you are ready to take that side hustle and make it the real deal. We'll let you know if incorporation is right for you!