With the RRSP deadline coming up this Friday, March 1, we wanted to bring in the perspective of an investment advisor to shed some light on the topic of investing and taxes. Megan Sutherland is an investment advisor with BMO Wealth Management. She's here to bust investing myths, give you the lowdown on how to choose between a RRSP and TFSA, and more. Read more about Megan and how to get in touch with her after the interview.

What financial/investing myth needs to be buried immediately?

Stocks are high risk and bonds are low risk. There is a spectrum of risk for all types of investments. Understanding those risks is the key to achieving financial success.

In what ways do investment advisors save people tax?

- Ensure the right investments are in the right account type based on investment income taxability, i.e. interest income in registered accounts and dividends/capital gains in non-registered accounts.

- Strategically manage RRSP contributions and RRSP withdrawals based on current and projected taxable income.

- Collaborate with clients’ accountants to strategize on tax management.

What question do you get the most every February?

What tax slips do I need to file my taxes?

TFSA or RRSP: what criteria do you use to help clients choose between the two?

Saving in an RRSP only makes sense if the person will be in a lower tax bracket in retirement, than when they earn the income. Some easy identifiers to help choose between an RRSP and TFSA are:

- You have reached your maximum earning potential or are in a high tax bracket - RRSP

- Need for flexibility, or to access the funds – TFSA

- Don’t need an income deduction or already have a lot saved in your RRSP (which will impact taxability in retirement) – TFSA

From what you’ve seen, what’s the best way a small business owner can save money to invest?

- Positive free cash flow.

- Be diligent and focus on a long-term strategy.

- Find balance between investing in the business and your retirement.

Leave us with one tip or bit of advice.

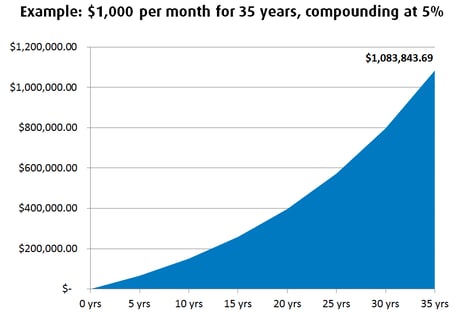

Compounding is king!

www.getsmarteraboutmoney.ca/calculators/compound-interest-calculator/

BMO Wealth Management is the brand name for a business group consisting of Bank of Montreal and certain of its affiliates, including BMO Nesbitt Burns Inc., in providing wealth management products and services. BMO Nesbitt Burns Inc. is a wholly-owned subsidiary of Bank of Montreal. If you are already a client of BMO Nesbitt Burns, please contact your Investment Advisor for more information. Opinions are those of the author and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). The information and opinions contained herein have been compiled from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. The comments included in the publication are not intended to be a definitive analysis of tax law. The comments contained herein are general in nature and professional advice regarding an individual's particular tax position should be obtained in respect of any person's specific circumstance

Thank you so much Megan!

We would like to add that you should always confirm your RRSP and TFSA contribution balances before you invest! If you have questions about any of this, please don't hesitate to reach out to me, or to Megan, if you have any questions.

Investment advisors can help you diversify your investments, make sure you're set for retirement and minimize your taxes along the way. Here's more about Megan and how to get in touch with her.

Megan Sutherland, BA, CIM, FCSI

Investment Advisor, BMO Nesbitt Burns

403.261.9508 or megan.sutherland@nbpcd.com

Megan began her career in financial services after graduating from the University of British Columbia in 2008. After getting a firm handle on industry rules and regulations, she left her position in compliance at a private firm to pursue being an Investment Advisor. Megan spent over six years at another major bank owned firm, providing top tier client service and wealth management advice, before making the move to BMO Nesbitt Burns. She holds the Chartered Investment Manager and Fellow of Canadian Securities Institute designations.

Read more about Personal Tax topics that may be helpful to you and your small business.

Like what you hear?

Are you on the hunt for a more proactive small business accountant? That’s us.