One of the biggest perks of running your own incorporated business is flexibility — especially when it comes to paying yourself. But that flexibility can also create confusion.

- Should you pay yourself a salary or dividends?

- Is one option more tax-efficient than the other?

- Can you split income with your spouse?

These are great questions. How you pay yourself doesn’t just affect your take-home pay today. It impacts your taxes, retirement savings, cash flow and long-term financial plan.

The good news? This decision is one of the best opportunities for incorporated business owners to save taxes. And while there’s no one-size-fits-all answer, understanding the basics will help you make smarter choices.

VIDEO: Curtis at True North Accounting explains why this decision is one of the best opportunities to save taxes as an entrepreneur.

Why this decision matters

As an incorporated business owner in Canada, your corporation is a separate legal entity. That means:

- Business profits belong to the corporation — not you personally

- You can’t spend corporate money on personal expenses without tax consequences

- Any money you take out must be reported properly as income

Many owners accidentally create tax problems by taking casual “draws” from the business without a plan. Others miss out on major tax savings because they default to one method without understanding the trade-offs.

That’s why this choice deserves a bit of thought — and ideally, some professional guidance.

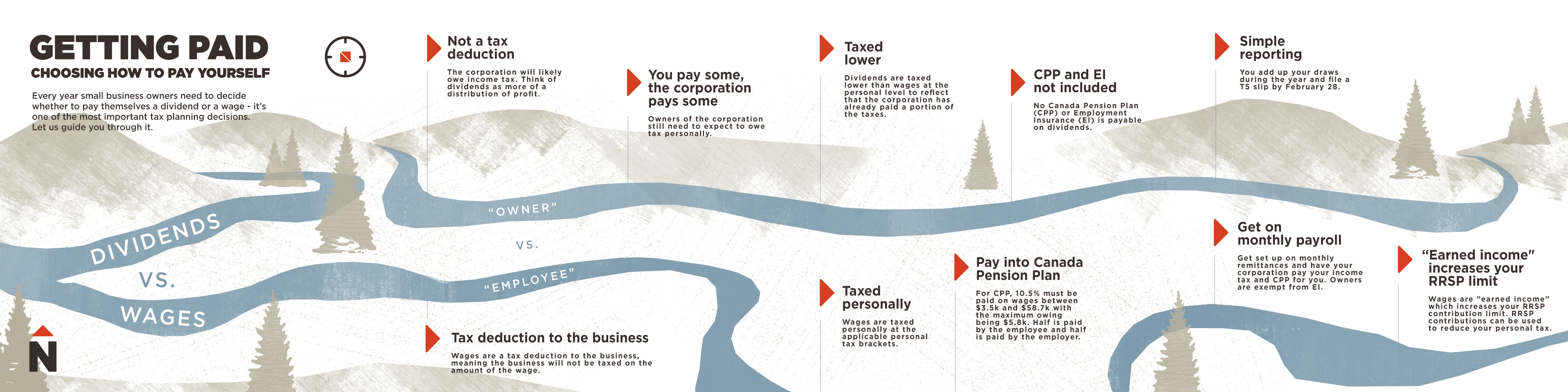

Click the image above for a close-up of this infographic.

Who this advice is for

This article is especially helpful if you are:

- An owner of an incorporated small business in Canada

- A shareholder (or spouse of a shareholder) who actively works in the business

- A service-based professional such as a contractor, consultant, freelancer, IT specialist, tradesperson or realtor

When it comes to paying yourself from your corporation, you generally have two options:

- Dividends

- Wages (salary or bonus)

Let’s break each one down.

Paying yourself in dividends

Dividends are paid to you as a shareholder, not as an employee. They come from profits the corporation has already earned.

Here’s how dividends work:

- The corporation pays you dividends from after-tax profits

- A T5 slip is issued to report dividends paid during the year

- Dividends are not a corporate tax deduction

- They are taxed at a lower personal tax rate due to the dividend tax credit

- No CPP or EI contributions are required

- Dividends do not create RRSP contribution room

From an admin perspective, dividends are relatively simple. Many owners take draws throughout the year, total them up, and issue a T5 slip by February 28.

Personal taxes on dividends are due by April 30.

💡 Good to know: If dividends are your only source of income, you can earn roughly $20,000 tax-free, depending on your province and personal situation.

Pros of dividends

- Simple and flexible

- No CPP or EI contributions

- Lower personal tax rates

- Helpful for income splitting (when allowed)

Cons of dividends

- No RRSP contribution room

- No CPP retirement benefits

- Requires disciplined personal tax planning

Paying yourself in wages (salary or bonus)

Paying yourself wages means you are treated as an employee of your corporation.

This can be done through regular payroll or as a year-end bonus.

Here’s what wages look like:

- The corporation issues a T4 slip

- Wages are a deductible business expense

- Income is taxed at your personal marginal tax rate (Learn about combined federal and Alberta tax brackets.)

- CPP contributions are required

- EI is typically optional for owner-managers

- Wages create RRSP contribution room

CPP contributions currently total 11.9%, split evenly between employer and employee, with a maximum annual contribution of $4,230.45 each.

Payroll remittances must be sent to CRA by the 15th of the following month, which adds a bit more administration.

💡 Good to know: Paying yourself a salary helps build retirement savings through CPP and RRSPs, which many owners value for long-term security.

Pros of wages

- Creates RRSP contribution room

- Builds CPP retirement benefits

- Deductible to the corporation

- Predictable income for mortgages and loans

Cons of wages

- CPP contributions increase total cost

- More payroll administration

- Less flexibility than dividends

Which option saves more on taxes?

Many business owners assume dividends are always cheaper because they’re taxed at lower personal rates. But once you factor in corporate taxes, the difference often narrows — and in some cases, wages can result in similar or even lower overall tax.

The real trade-off usually looks like this:

- Dividends: Lower admin, no CPP, but no forced retirement savings

- Wages: Slightly higher cost due to CPP, but long-term benefits through CPP and RRSPs

There’s no universally “better” option — just the option that best fits your goals.

Other ways to get money out of your company

In certain situations, there may be additional strategies available, including:

- Shareholder loan repayments (if you’ve lent money to your corporation)

- Management fees (when services are provided by another corporation)

- Capital Dividend Account withdrawals, which can be tax-free in specific cases

These strategies require careful planning and proper documentation — but when used correctly, they can be powerful tools.

The smartest approach? A mix

For many incorporated business owners, the optimal strategy isn’t choosing one option — it’s combining salary and dividends.

A blended approach can:

- Minimize total tax

- Create RRSP room

- Reduce CPP costs

Smooth cash flow - Support long-term retirement planning

This is where personalized advice really pays off.

Let us crunch the numbers for you

Deciding how to pay yourself isn’t just a tax decision — it’s a business and life decision.

At True North Accounting, our CPAs will:

- Analyze your specific situation

- Compare after-tax income under different scenarios

- Help you choose the right balance of dividends and salary

Keep you compliant and stress-free

We’ll also simplify your bookkeeping, payroll and tax filings so you can focus on what you do best — running and growing your business.

📅 Ready to make the most of your income?

Book a chat with us today and let’s build a pay strategy that works for you — now and into the future.

Read more about Starting a Business topics that may be helpful to you and your small business.

Like what you hear?

Are you on the hunt for a more proactive small business accountant? That’s us.

-1.png)