We are in uncharted waters with the Covid-19 outbreak. Nothing is more unnerving to small business owners than uncertainty, and there's a lot of it right now. We have big news and lots of important information that you need to know.

If you're wondering what kind of government initiatives are in place for small businesses, we've got you covered.

We're going remote

The guidance we're getting says to limit close contact with others - and our office gets busy during March and April. So as not to contribute to the spread, our offices will NOT be open for meetings or document delivery/pickup, effective today.

Your taxes will still get done on time, we will just need to make it happen electronically. Every member of our team is set up to work remotely, and stay connected to our clients and to each other.

Taxes are now due September 30 (instead of April 30). And we will still be operating as normal (just remotely).

Two steps to get your taxes done

It might even be easier to do your taxes during this time. Get all your tax return gear and lock yourself in your home office. Take your favourite focus potion and don't let anything interrupt you until you're done.

Step 1: Digital document delivery

Please use the Karbon tax checklist that was emailed to you. This is an electronic list of all the things we'll need to get your taxes done, and you can upload your files to each task item.

You'll be asked to create a 4-digit PIN the first time you enter the checklist.

If you must deliver paper, there is a parcel delivery box at both of our office locations.

Use the Scanbot app on your phone to snap pics of your paper documents and save them as PDF - it's super slick and it's free! Hubdoc is a digital filing cabinet that will automatically download your bank statements and vendor bills. It also has an app for snapping pics of receipts.

Step 2: Tax completion checklist

When your tax return is complete, we will email you another checklist, which includes a few more tasks before we can file your taxes:

To wrap up the tax season, you just need to pay your taxes (due April 30), and schedule your instalments for the next year using your online banking.

Troubleshooting the technology

1. The kick-off and completion checklists:

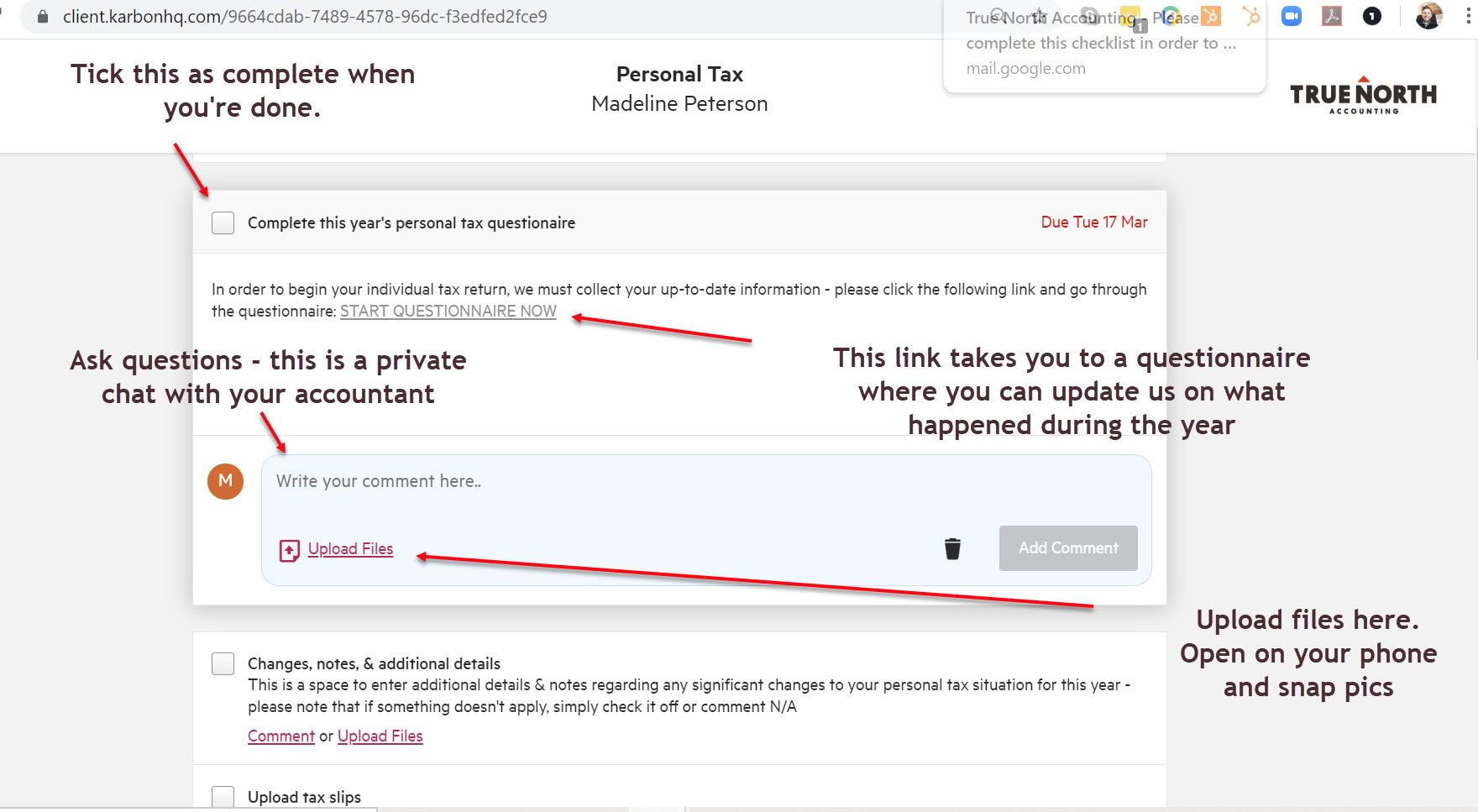

These checklists are sent using a program called Karbon. On March 14, you should have received an email from Karen Gotoc (Accounting Manager with True North) with the subject line, "True North Accounting - please complete this checklist." This is an electronic list of all the things we'll need to get your taxes done, and you can upload your files to each task item. Check your junk folder if you don't see it in your inbox. Reach out if can't find the email.

You'll be asked to create a 4-digit PIN the first time you enter the checklist. This replaces a username and password - make it something easy to remember like your birthday or the last 4 digits of your phone number.

Use the Scanbot app on your phone to snap pics of your paper documents and save them as PDF - it's super slick and it's free! Hubdoc is a digital filing cabinet that will automatically download your bank statements and vendor bills. It also has an app for snapping pics of receipts.

Here is what you can expect to see:

2. The proposal:

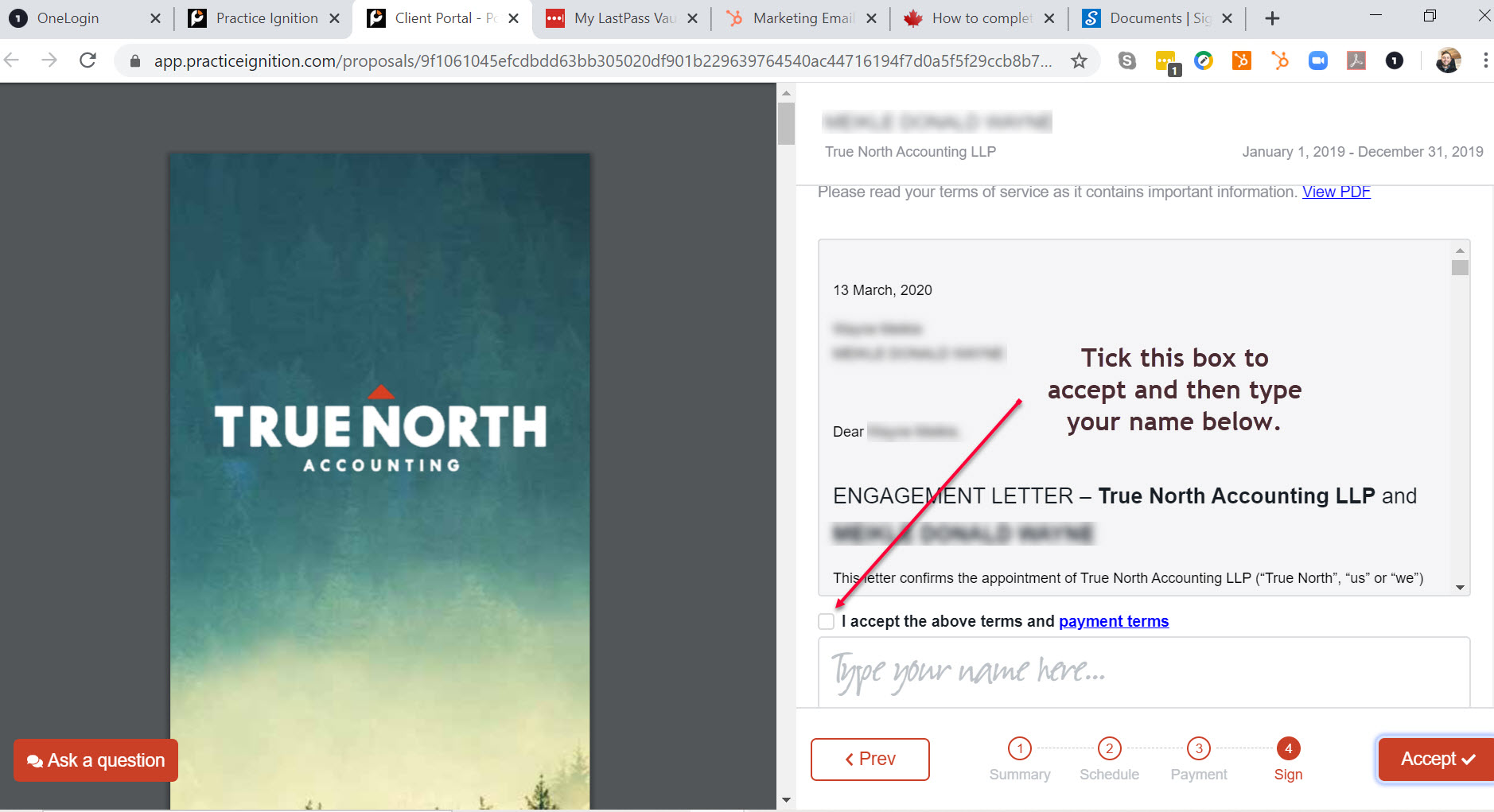

In the second task of the Completion Checklist (sent once your taxes are complete), will be a link to a proposal, which we prepared using a program called Practice Ignition. Click the link and you'll be taken to a 4 step proposal where you can review the price, enter your credit card number and accept/sign the engagement letter.

If you're having trouble accepting the proposal, it might be that there is a checkbox that needs to be ticked off. See the image below - this occurs after you have entered your credit card and before you enter your name to e-sign the engagement letter:

3. E-sign the T183 (authorization for e-file)

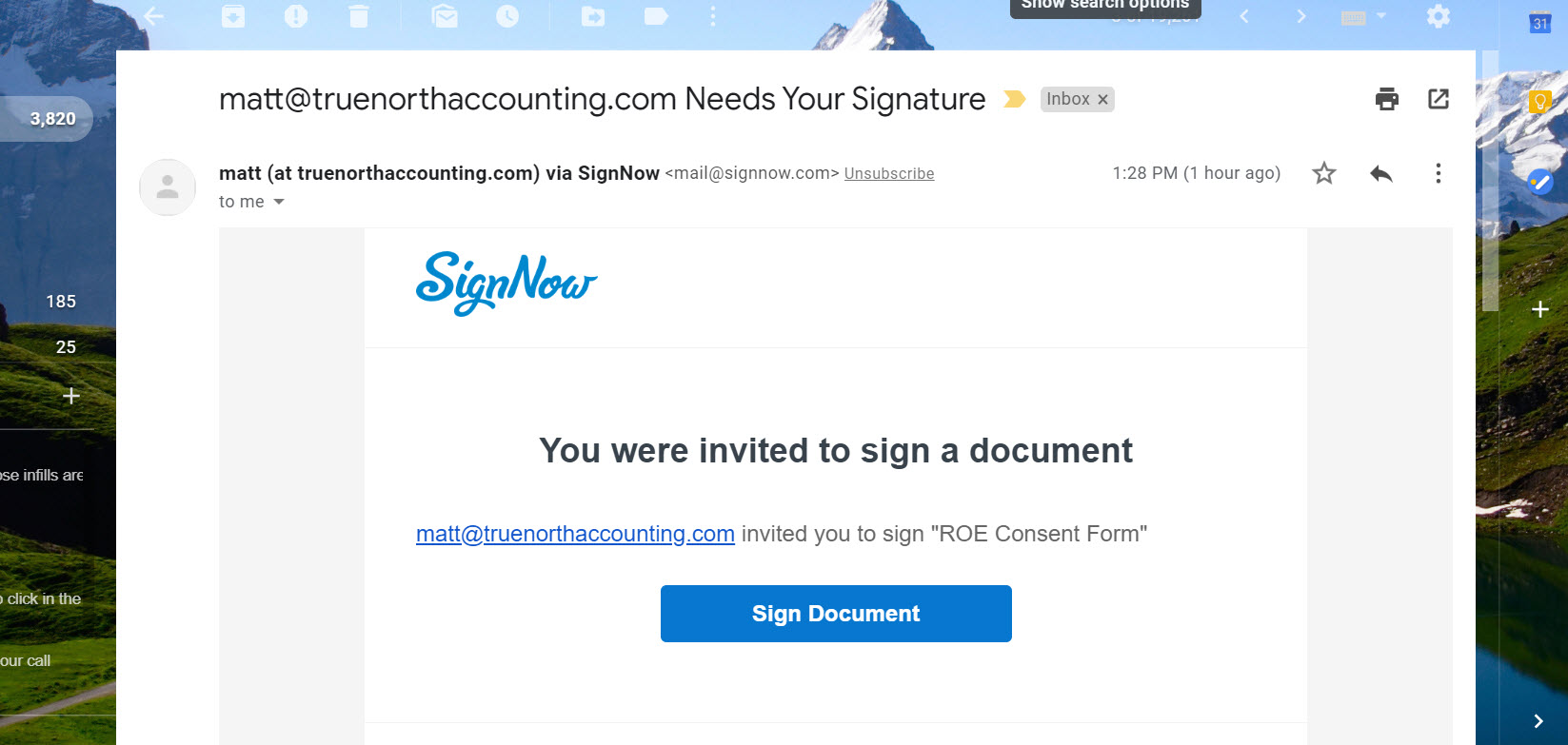

The last step before we can efile your taxes is to sign the authorization to efile form. We'll be using a program called SignNow to get your electronic signature. You'll receive an email from "matt(at truenortha.", sent from mail@signnow.com, and a subject line that says "matt@truenorthaccounting.com Needs Your Signature".

Here is what it looks like

Just follow the prompts and create a signature - it doesn't need to resemble your actual signature, just something with your name is fine.

You won't need to download a PDF - the program will send it directly to us. So just close the window when you have successfully submitted your signature.

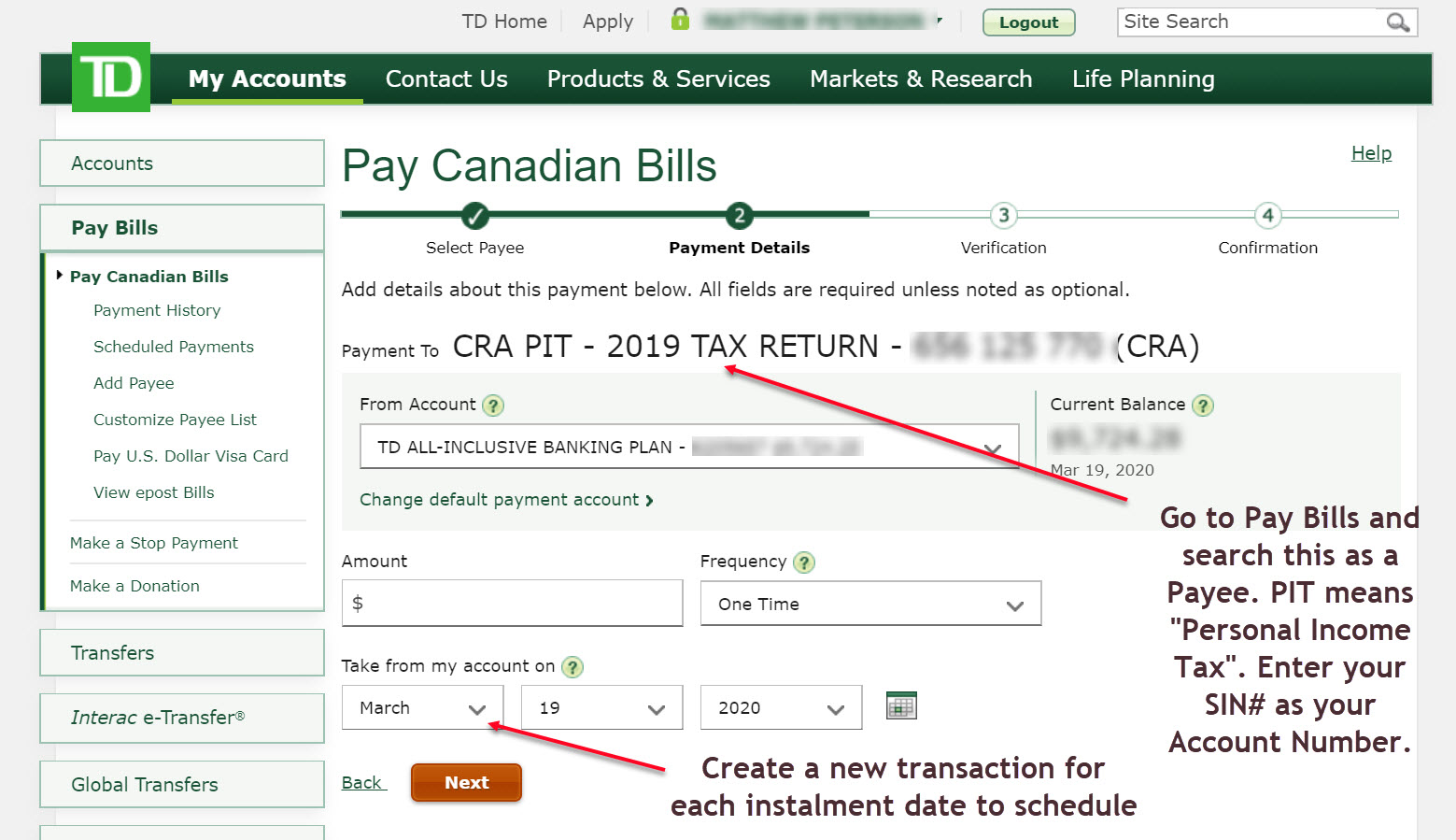

4. Pay your taxes and schedule your instalments

If you have a balance owing, you can use your online banking to make the payment (which takes 24 hours to process). For this year, the payment deadline has been deferred from April 30 to Sept 30 - as long as you did not file your taxes prior to March 18, 2020.

If you owed more than $3000, you will be required to make tax instalments during the year, which are due June 15, September 15, December 15 and March 15. You can also schedule these payments right now.

Here are some instructions for how to make this payment:

During tax season we experience a high volume of calls, and we have a lot of actual tax returns to file, but we are more than happy to help you through this process. We do ask for your understanding and patience on this and we really appreciate you making the attempt to learn a few pieces of new technology!

We're here with you on this journey and will keep you posted on news as things unfold on our Facebook, Linkedin, Twitter and Instagram accounts below.

Read more about Personal Tax topics that may be helpful to you and your small business.