If you’ve ever asked your accountants whether you should own your vehicle in your corporation or personally, I’m betting they didn’t tell you much. They probably said, “Well, it depends.” If you are sick of hearing this response, then you are not alone. The good news is we can give you the answer you need.

Vehicle expenses are one of the most important deductions available to small business owners. We want to focus on the owners of private corporations in Alberta.

There are three factors that really determine how you should treat your vehicle deductions. Note your answers to these three questions:

- What's your vehicle worth today?

a.) Under 15k

b.) Over 30k

c.) Between 15k and 30k

d.) Leased - How many kilometres do you drive per year?

a.) Over 25,000 km

b.) Under 10,000 km

c.) Between 10,000 km and 25,000 km - What percentage of kilometres driven were for business purposes?

a.) Under 50%

b.) Over 50%

c.) Pretty much 100%

d.) Almost none

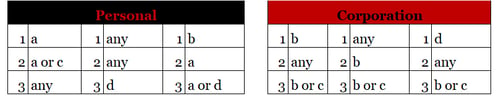

Now, find your answers on the grid below to see whether you should own your vehicle personally or in your corporation:

If you can’t see your group of answers on either grid, this means it’s too close to call or you fall into a grey area, and we should probably chat about it.

Value of vehicle

Low Value: If your vehicle isn’t worth much (under 15k) and is relatively cheap to operate, it likely makes sense to own it personally and charge the corporation a $/km rate.

High Value: If your vehicle is new or worth more than 30k, it likely makes sense to own it in your corporation — unless it is actually a personal vehicle, in which case you wouldn’t feel right calling it a business vehicle.

How much do you drive?

Low: If you don’t drive much, it probably makes sense for your corporation to own (or lease) the vehicle.

High: If you drive a lot of kilometres each year and your vehicle isn’t worth all that much, you would probably be better off owning it personally. If the car is more expensive and has high kilometres, the corporation should own (or lease) it.

Does the vehicle have high or low business use?

Low business use means less than half the kilometres are for business purposes. If the vehicle has low business use, low kilometres, and high value, it may seem you should own it personally, but this is one of those grey areas. In some cases, it might still make financial sense to own it in the corporation. We should chat if this is you.

High business use means more than half the total kilometres driven is for business. Unless the vehicle’s value is low, the corporation should own it when it falls into the “high business use” category.

When the corporation owns the vehicle

The corporation should pay for all of the operating expenses for the vehicle; then, the personal use portion is transferred to the owner’s compensation. Unless all use of the car is business, you still need to keep track of the total kilometres driven during the year and the business kilometres driven. If your vehicle is for business use, you should probably have a second personal vehicle in the household.

The easiest way to log your kilometres is to book oil changes at the start of every fiscal year so you can track your starting and ending kilometres. MileIQ is a great app for tracking the business kms.

The vehicle must be registered and insured in the corporation’s name. If the car is financed, the financing should also be in the corporation’s name. If you lease, the lease must be in the corporation’s name.

When you own the vehicle personally

You should personally pay all the operating costs, including insurance, registration, gas, oil changes, and tires. You track all the kilometres driven for business purposes and charge the corporation $0.72/km for the first 5,000 km and $0.66/km for everything over 5,000 km. The corporation can pay you this amount tax-free; however, the actual expenses are not deductible.

Lease buy-out trick

If you lease the vehicle through the corporation and have a favourable buy-out at the end of the lease, you can choose to buy out the vehicle personally. It might not always make sense to do this, but in certain situations, it can be quite favourable to the owner personally.

If you are still unsure whether you should own your vehicle personally or in your corporation, make an appointment. We can walk through your specific scenario and give you some guidance. You can also find more info on our Corporate Tax Services page.

Read more about Corporate Tax topics that may be helpful to you and your small business.

Like what you hear?

Are you on the hunt for a more proactive small business accountant? That’s us.