This new budget is a shocker. Business owners need to be informed about what’s changing with the 2024 federal budget and how it will impact their financial position.

Main points covered in this blog:

- Capital gains changes

- Lifetime capital gains exemptions

- Canada Entrepreneur Incentive

- Carbon rebate for small businesses

- Home Buyer Plan changes

- Flipping houses

- Tax rates by sector

- Increased power for the CRA

Here’s a rundown of what’s new in Budget 2024, given the tagline “Fairness for every generation.”

Capital gains inclusion rate increases to 67%

Starting June 25, 2024, the capital gains inclusion rate for individuals who realize capital gains exceeding $250,000 in a tax year will increase from 50% to 67%. This means that if you sell an investment for a profit of more than $250,000, you’ll be taxed at a higher rate. However, if capital gain occurs in a corporation or trust, the $250,000 threshold does not apply, so the inclusion rate is 67% from the first dollar.

The budget does not change the tax rate — only the taxable portion of the gain on the sale of an investment is increasing.

Example: Your corporation sells an investment after June 24 for $100,000 more than you bought; $ 66,667 goes on your tax return as taxable income rather than $50,000.

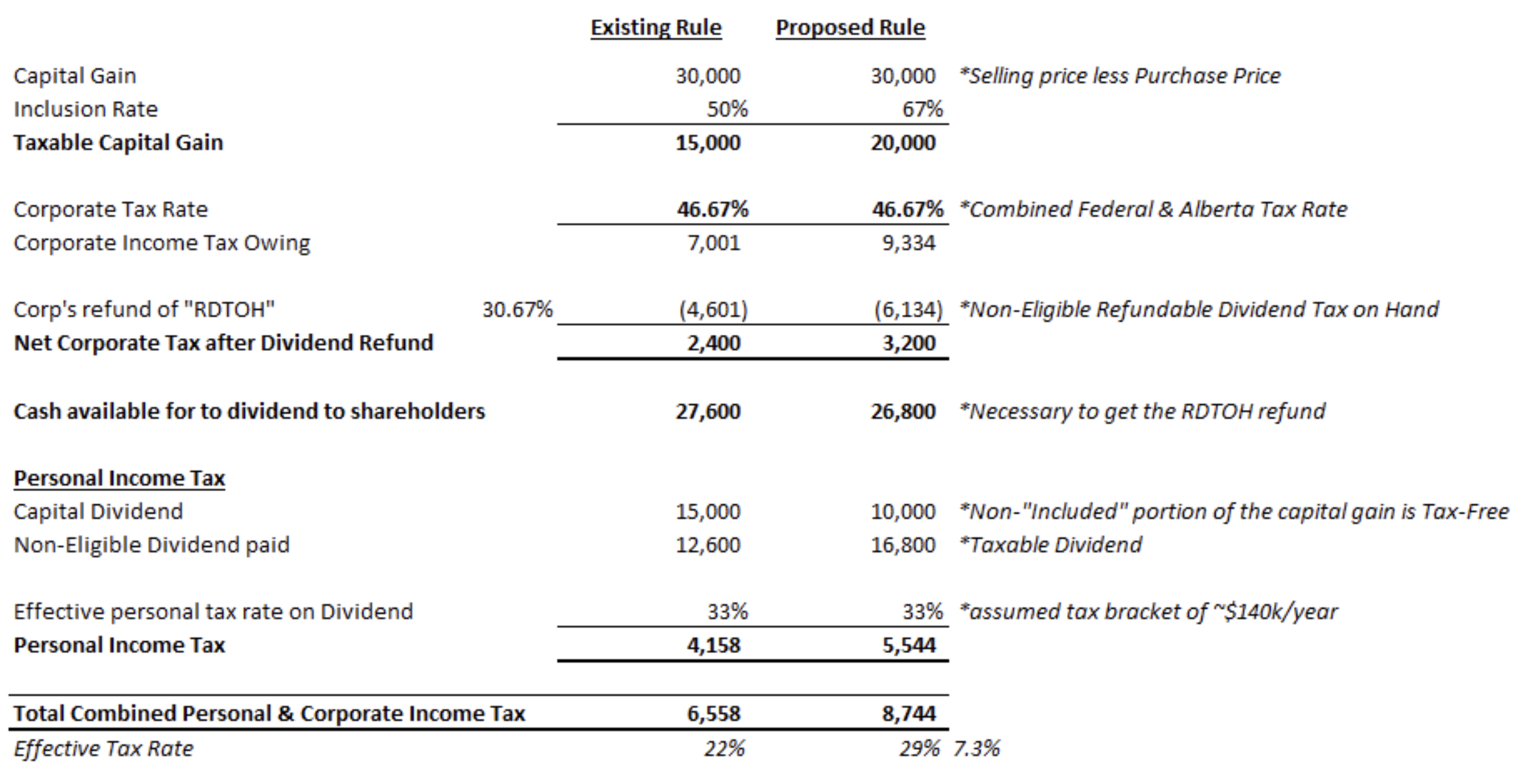

Here’s an illustration of how a $30,000 capital gain would be taxed in a corporation, first under the pre-June 24 rules and second under the proposed rules after June 24.

In this scenario, the taxes owing at the end of the day will increase by 7.3%. For tax years that begin before June 25 and end after June 25, two different inclusion rates would apply, requiring us to identify and track all transactions and treat them separately, depending on the date the transaction closed.

Lifetime capital gains exemption (LCGE) boost

Increasing the LCGE is undoubtedly a good thing — don’t get me wrong. However, given the 66.7% inclusion rate, the changes had to be made to keep the benefit at the same amount. The limit will increase from $1,016,836 to $1,250,000 on June 1, 2024.

For small business owners, tracking all the details of share transactions, investments, or changes in how they make money in their corporation is more important than ever. If you buy a property in your corporation, start an investment account, take on clients outside Canada, partner with a non-resident or stop earning “active business income,” you must talk to your accountant about how this might impact your LCGE.

Reach out to True North if you’d like us to help you.

Integration in the tax system

Now, there is a tangible difference in how you make investment decisions; for business owners, it’s a much more complicated decision. Do you invest in growth or cash-flowing assets? Buy in your corporation or family trust or max out your RRSP or TFSA? Do you start your business as a sole proprietor or incorporate? Is a holding company still helpful? What about a family trust?

When you combine these new capital gains rules with the 2018 passive income tax hikes, there’s a pretty stark difference between investing as an individual and a corporation or trust, which throws our whole tax system out of sync.

Tax integration aims to ensure that no matter how you make an investment or earn income — whether through a corporation, trust or personally — the tax burden at the end of the day should be somewhat equal (within a % or two).

This principle is fundamental and has always worked well. It ensures corporations can’t be used to avoid taxes, only defer them. This is achieved through the dividend gross-up and other refundable tax credits, like refundable dividend tax on hand (RDTOH). While this confuses small business owners every year, it helps achieve tax parity, prevent double taxation, and set the landscape for neutrality in investment decisions.

This budget throws all that out the window.

Should I sell investments before June 25?

There is no draft legislation yet, which implies that the Department of Finance hasn’t fully vetted these changes. There is a lot of work to do and questions that need to be answered before this goes to the House and Senate and eventually passes into law. We need a lot of details before this happens.

And this government needs to improve at drafting legislation.

Remember the Underused Housing Tax? It was announced, but there was so much pushback that it was delayed for two years before finally being implemented in 2022.

The tax on split income (TOSI) laws, better known as the income sprinkling rule, was announced in the 2017 budget and underwent massive changes before it came into effect in 2018. They at least had draft legislation, but they hadn’t done the proper stakeholder feedback loop and just announced it with embarrassingly bad legislation.

The bare trusts reporting requirements have been discussed since the Liberals first got into power, and they finally went full-bore for the 2023 tax year, making us all panic about filing trust returns by the March 31 deadline. Then, on March 12, 2024 — 19 days before the deadline — after accountants, lawyers and hundreds of thousands of Canadians wasted countless hours wrapping their heads around whether they’re a bare trust or not — the government said, “Actually, you don’t have to file this year. We’re going to re-think this one.”

This time waste was reported to have cost Canadians $1 billion.

Don’t act too hastily and sell off a bunch of investments to realize capital gains before the rules come in. Sure, you might save some tax, but you might also unnecessarily trigger a big tax bill. If you want to sell, run it by your accountant first (and preferably wait to ask them until after the April 30 tax deadline).

In fact, any time you want to buy or sell an asset or investment, you should consult your accountant. Don’t act hastily based on a friend’s advice because every situation is unique, and there are now so many factors at play that you want good advice.

Canadian Entrepreneurs’ Incentive (CEI)

There is a new exemption for entrepreneurs selling qualifying shares, which will result in a ⅓ capital gains inclusion rather than the new ⅔ inclusion rate. For those who qualify, the inclusion rate is reduced to 33.3% for up to $2 million in eligible capital gains over their lifetime. Once fully implemented, this incentive means entrepreneurs could have a combined exemption of at least $3.25 million when selling all or part of a business, ensuring a more rewarding entrepreneurial journey.

To qualify for this incentive, the following must be true:

- You personally owned the shares of a Canadian Controlled Private Corporation for five years before disposition.

- You sell the shares of your business for fair market value — note that asset sales do not qualify. This is the most common way to sell a business.

- You are a founding investor, owning more than 10% of the voting shares, and were actively involved in the business on a regular, continuous and substantive basis.

- The business is NOT a professional corporation; sorry, doctors, dentists, lawyers, accountants, chiropractors, veterinarians, pharmacists and optometrists.

- The business does not operate in the financial services, insurance, real estate, food and accommodation, arts, recreation, or entertainment sector or provide consulting or personal care services.

There are a lot of exclusions, and it is hard to see the logic in how they were chosen, but for those select entrepreneurs who qualify and who sell their businesses in the right way, their capital gains inclusion rate is cut in half. The CEI program will roll out with a $200,000 exemption cap in 2025, increasing by $200,000 every year for 10 years, at this point, up to $2 million in capital gains will be eligible for the 1/3 inclusion rate. This gradual phase-in approach means that if you sell your shares in 2025, the maximum benefit is $35,000, but in 10 years, this will be worth up to $350,000.

There is no guidance around what it means to be a “founding” investor. Will you only qualify if you were a shareholder on record during the initial incorporation? What if you bought in three months later? No clear definition is provided yet.

This one won’t have much impact on the phase-in approach, but it will be a good incentive for some in the long run.

Canada Carbon Rebate for small businesses

Aiming to support about 600,000 small businesses in designated provinces, the New Canada Carbon Rebate will directly return over $2.5 billion to small and medium-sized businesses through a refundable tax credit. This helps to ease the financial burden of carbon pricing and encourages eco-friendly practices.

This is the carbon tax the government has collected since 2019. It has just been sitting on the excess cash and is now finally paying it out. The carbon tax is supposed to be a fully revenue-neutral tax, meaning whatever it collects from carbon consumers is paid out to other taxpayers, primarily individuals. However, small businesses are now being included for up to $2.5 billion.

To qualify, the corporation must be a Canadian-controlled private corporation (CCPC) with at least one employee. If you only take dividends, you won’t get it. The amount is based on the business’s number of employees and the province it operates in. This rebate goes back to 2019 when the carbon tax was first introduced, so payouts will be calculated for each year based on your business’s size, and the refund will be issued automatically if you’ve filed your taxes and T4 slips for those years. For 2023, ensure you’ve filed all your taxes by July 15 to get paid!

Home Buyer’s Plan

This budget also includes increasing the Home Buyers’ Plan withdrawal limit from $35,000 to $60,000 from an RRSP account. The repayment period will now start in the fifth year following the first RRSP withdrawal.

As a reminder, this program allows you to withdraw funds from your RRSP account — on a tax-free basis — to purchase your first home. Then, you have a five-year grace period before you need to start paying the piper, at which point you have 15 years to either pay the funds back into the RRSP without the tax benefit or include the amounts in your taxable income each year.

Say you withdraw $60,000 from your RRSP on July 1, 2024, to buy your first home (which is a qualifying or accessible home for people with disabilities); there would be no tax owing on the withdrawal as long as the entire amount goes toward your downpayment. Then, on July 1, 2029, you start the 15-year repayment period, which means you would claim $4,000/year in additional income on your tax returns for the next 15 years. Depending on your tax bracket, your tax bill will increase by as much as $1,920/year.

Flipping houses

The government has taken a firm stance on property flipping to ensure that homes serve as places to live rather than speculative investments.

As of January 1, 2023, if you flip a home (i.e., buy it and sell it within a year), it doesn’t count as a capital gain and instead is 100% included as income. There’s no change to this in the budget. Property bought and sold within a year is considered business income, and taxes reflect this change.

Crypto asset reporting

Starting in 2026, Canada is adopting the Crypto-Asset Reporting Framework (CARF), an international cooperative effort to gather information on crypto-assets so governments can tax them. Canadian crypto exchanges will be required to share information on their customers and crypto-asset transactions with the government agencies of other countries participating in CARF.

Tax rate changes by sector

Tax rate changes by sector

Here are some general tax changes you may be interested in:

- Effective tax rate for new investments in Canada will increase from 13.7% to nearly 17%.

- Tax on machinery and equipment investment — a critical source of labour productivity growth — will see an increase from 5.7% to 14.2%.

- Effective tax rate in agriculture will increase from 8.1% to 11.6%.

- Effective tax rate in construction will increase from 20.8% to 22.5%.

Increased power for the CRA

Ever ignored one of those brown envelopes you know is from the government? Well now, this budget proposes a new $50/day non-compliance penalty for individuals who fail to comply with the CRA’s information request — up to a maximum of $50,000!

The budget also gives the CRA the power to require information and documents submitted to them to be done so under oath or affirmation. Providing false statements under oath is considered perjury, a serious criminal offence that could result in a prison sentence of up to 14 years! This also impacts your credibility in tax court, business and professional life.

Conclusion (if you take away anything, take away this)

Talking to your CPA before you make any important financial decision is more important than ever, so you understand the impact. Protect yourself by giving your accountant all your purchase and sale documents for every asset or investment transaction.

Our entrepreneurial CPAs will understand your situation and give you tailored insights so you can keep more of your hard-earned money. If you need a hand navigating the numbers or want to bounce some ideas around, feel free to reach out to us.

Read more about Small Business Basics.